One of the areas I have found fascinating to track is how the Internet has been dramatically disrupting many traditional business models and industries. Newspapers have been the perfect example of this. I decided to take a closer look at one of the most popular traditional newspapers, the New York Times, to see how they are adjusting as a business to the shifts within their industry. Below are a few takeaways and thoughts I had while reading through some of their recent annual reports.

How the New York Times makes money

For a background, the Times classifies three primary categories of revenue:

- Advertising

- This covers all of the print and digital advertising that they do, which is primarily display advertising with a small amount coming from classifieds.

- Circulation

- This covers sales of their print newspaper and subscriptions to their digital products.

- Other

- Always a small percent of the total pie, covers more minor areas such as news services, syndication, digital archives, among others.

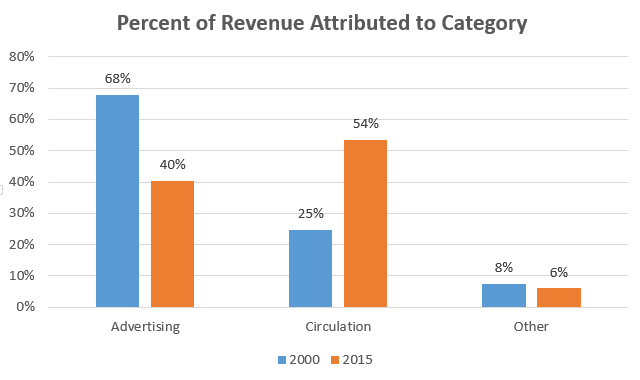

The New York Times has seen a fairly significant shift over the last 15 years, from a model driven primarily by advertising to one driven increasingly by subscription. This shift is being borne out of necessity and as a result of greater changes in the advertising market over the last 15 years. The below graph illustrates that shift in their model.

Revenue trends over the last 5 years

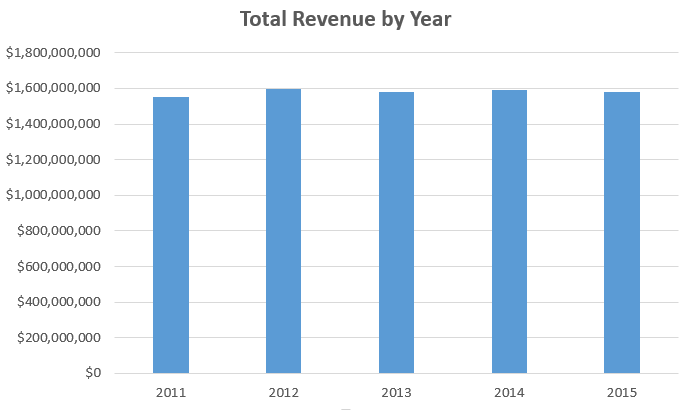

From a revenue perspective, the New York Times has seen some pretty stagnant growth over the last 5 years.

In some regards, they should be applauded for maintaining similar top-line numbers (and an operating profit to boot!) while they’ve seen continued erosion of their former primary revenue driver, print advertising. This is a common theme among newspapers: print advertising revenues have been falling across the industry for a number of years now.

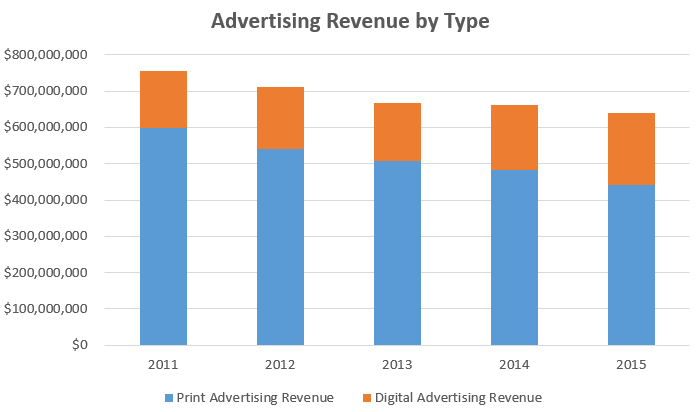

As you can see above, they have seen some growth in digital advertising revenues, but it hasn’t been enough to offset the print advertising declines. It’s hard to see that print advertising trend reversing itself at any point.

Digital subscriptions to the rescue?

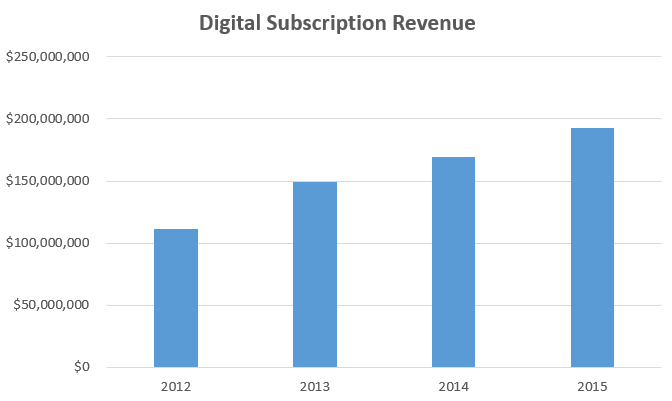

One of the saving graces for the Times has been their digital subscription offering, which they unveiled in 2011. In addition to the print advertising declines, they’ve also been experiencing declines in print circulation revenues as well. Their digital subscription packages have more than made up for these declines. The big question looking forward will be whether they can continue to lean on digital subscriptions to offset losses in other areas of the business.

Thoughts on their future

Continued Print Declines

It seems inevitable that print advertising and print circulation revenue will continue to fall over time. If those declines start to accelerate, they may find themselves in an incredibly tough situation.

Cost Structure

I would presume there will be continued focus on optimizing their cost structure to be able to compete in an increasingly digital-focused world. Many of the newer media companies are not burdened with some of the costs that they are (large employee base, print production costs, paying out pensions being a few examples).

Focus on Quality & Innovative Storytelling

I would hope they would continue to value quality and new ways of telling stories as part of their value proposition to buoy further growth in their digital subscriptions. There is always the temptation to play the cheap content and clickbait article game, but I don’t know that this would serve them well. Perceived quality of their journalism is one of the differentiators for their business.

Digital Subscription Pricing

It will be interesting to see if there will be downward pressure on the pricing of their digital subscriptions in the future. News content is becoming more commodified in an increasingly Facebook-dominated world. Facebook has become one of the big distribution channels for news content, which is a shift from a world where newspapers like the New York Times could leverage advantages they had in distribution. Nowadays, their distribution advantage is eroding away a bit, and they are on relatively equal footing with every other news site/blog all vying for the same attention on Facebook (this is not to say Facebook is their only channel, but it’s becoming more important).

Expanding Digital Offering

The New York Times has expanded their digital offering over the last few years, creating a Crosswords subscription product, a Recipe site, and have started diving into VR news recently, among other developments. I would expect to see them to continue creating new and innovative products that play to their core strengths, with the possibility of monetizing them via subscriptions in the future.

User Experience Tactics

I’m curious to see if they will start playing around with how many articles they allow the average visitor to view before blocking access, or if there will be more aggressive attempts at having visitors turn off their ad blockers to view their site. A number of their competitors have become increasingly aggressive on these fronts, perhaps at their own expenses. There is a delicate line to walk as a media site between trying to extract revenue from your existing visits and ensuring you are not driving away future visits because the experience is too friction-filled.

Conclusion

While I am not overly bullish on the long-term prospects of the Times given the existential threats to a significant portion of their business model, I do think they are approaching the shift from print to digital in a smarter way than a lot of their traditional competitors are. They will be an interesting company to follow with how they handle the ongoing changes in their space.